|

|

|

|

|

| http://www.amplifimedia.com/blogstein/2017/8/30/a3u0b41e1vaklpoievxw1qeqfm0z4p There are over 100,000 DIGITAL RADIO STATIONS!!! Posted on November 11, 2017 by Steven Goldstein Radio Stations like Big Machine Radio http://www.bigmachineradio.com Sometimes technological innovation takes away. Sometimes it gives. Walk into any Best Buy and look for an AM/FM radio and it will be difficult to find one, but there are "new radios" right at the front of the store. Digital has changed so much of legacy media. The music business was famously rocked by theft and illegal sharing on platforms like Napster. The movie industry filed suit against VCR makers, but later made billions with VHS tapes, DVDs, and streaming video. Print publishers now reach more people than ever — but on digital platforms. Today, television has evolved to a predominantly on-demand medium, having crossed the 50 percent threshold from live viewing a few years ago. People watch shows at a time of their choosing. So, where is commercial radio in the vortex of digital change? It is at a remarkable inflection point; streaming and mobile are becoming giants and forcing the rethink of AM/FM-only distribution strategies. Audio listening is growing, however, people are accessing and listening to audio on new devices that don't have AM/FM dials. The "new radios" in the front of the store are smartphones and smart speakers and how people listen to audio on them is different than linear AM/FM. Read More |

|

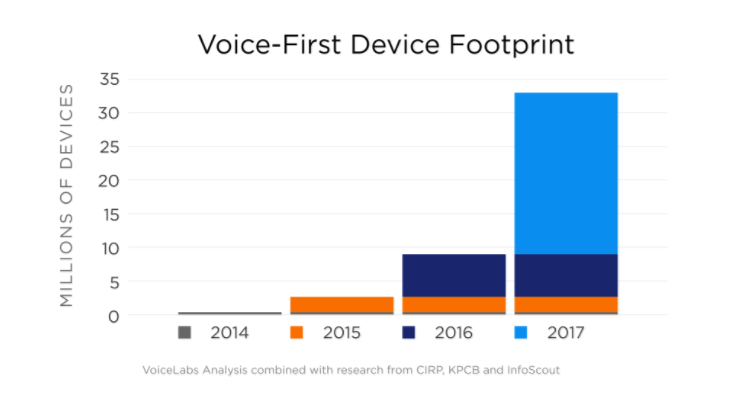

| http://voicelabs.co/2017/01/15/the-2017-voice-report/ Voice Labs The 2017 Voice Report by VoiceLabs Million in 2016 Posted on November 11, 2017 by by Adam Marchick In 2017, VoiceLabs predicts there will be 24.5 million devices shipped, leading to a total device footprint of 33 million voice-first devices in circulation.

|

|

| http://www.billboard.com/files/pdfs/Bulletin/january-31-2017-billboard-bulletin.pdf Billboard Bulletin SoundExchange Paid Out $884 Million in 2016 Posted on January 31, 2017 by ED CHRISTMAN SoundExchange paid out $884 million in royalties to artists and labels in 2016, a 10.1 percent increase over the $803 paid out in 2015. "We distributed record-setting royalties to artists and labels in 2016 and broadened our charter beyond our original role of administering statutory licenses," SoundExchange president and CEO Michael Huppe said in a statement. "In 2016, besides processing digital radio payments, we also launched new data validation services, managed the distribution of royalties for over a dozen direct licenses, and administered some critical industry settlements. These are significant milestones." While SoundExchange remains the largest collector and distributor of statutory royalties to artist and labels for recorded music, during the year, SoundExchange managed 15 direct licensing deals, including Pandora’s deals with record labels, which began in the fourth quarter. According to previous financial reports, SoundExchange, which began life exclusively administering compulsory licenses paying statutory rates, has been diversifying its capabilities to handle administration for direct deals. For example, in 2015 SoundExchange collected $888 million, of which $846 million was from statutory deals, which means that $42 million came from handling payments for direct deals. That’s up from slightly from the $38 million in royalties from direct deals it collected in 2014 when statutory payments comprised $755 million of the $788 million in total collections. SoundExchange said it has not yet determined how much revenue it collected in 2016 and wouldn’t be able to provide that number until it filed its 990 form later in 2017. The 990 form is the annual reporting form for non-profits in the U.S. Meanwhile, during 2016 SoundExchange also implemented a new end-to-end business platform to manage rights, repertoire and royalties. The company also launched what it claims is the industry’s first public International Standard Recording Code (ISRC) database, in cooperation with IFPI. The latter database provides information on about 30 million sound recordings. Also last year, SoundExchange launched a new Spanish-language registration module to service Latin artists and labels. |

|

| http://www.thehypemagazine.com/2017/01/digital-radio-tracker-launches-free-searchable-artistsong-airplay-database/ Hype Magazine Digital Radio Tracker launches free searchable artist/song airplay database Posted on January 20th, 2017 by Jerry Doby Digital Radio Tracker (@DRTRadioTracker) has brought a new dimension to monitoring online radio spins which in today’s era of digital evolution, is a key resource and tool for indie artists, labels AND radio stations. Gone is the day when internet or online radio airplay means nothing. Traditional Performance Rights Organizations have only just begun to add digital tracking and the foremost leader is unquestionably Sound Exchange…YES you can get paid from online radio spins! A key benefit with Digital Radio Tracker, is the ability for those who pay for radio promotion packages to see if their money has been well spent or if they’ve been victim of a rip off. The upstart company appears to have the missing link for indies and majors alike, considering even terrestrial radio has gotten into the streaming space utilizing tools such as the Tunein app which allows listeners to take their favorite stations with them via their mobile devices. Here’s the official line on the new service from Digital Radio Tracker: In today’s music industry one has to be up-to-date on cutting edge trends in a variety of key areas. A focal point standing above the rest is technology. DigitalRadioTracker.com Inc. (DRT), a private U.S. based firm, is breaking down barriers with innovative, creative and lucrative marketing research initiatives to its clients. DigitalRadioTracker is now offering a free searchable artist/song airplay database for all account holders. This new feature allows users to search the DRT database that currently tracks over 30 million titles and continues to expand. This amazing research tool allows users to search for song titles and artists that are receiving airplay allowing them to pinpoint exactly the information they need. DigitalRadioTracker has developed a proprietary system that monitors over 5000+ Internet Radio stations as well as select Terrestrial FM, College & Non-Commercial radio compiling the airplay of songs around the globe. DRT Reports provides users with detailed information of when, where and how often songs are being played on the radio as well as its version. Artists and music-related companies wanting broader capitalization to their songs released have the ability to manage that information more effectively. "We’re hoping to help everyone save time and money while offering them greater convenience with the search feature. We want to assist music-related companies drive profitable growth and expand to new heights and this tool is the solution." says DRT's Joel Bachman |

|

DIGITALRADIOTRACKER TRACKS INTERNET RADIO SPINS

http://digitalradioreport.soundexchange.com/2015q4/

SoundExchange Paid Out a Whopping $773 Million in 2014: Another way to appreciate SoundExchange's ascension is to look at annual growth in dollar terms. Last year distributions grew $183 million, up from $164 million in 2013 and $134 million in 2012. The rate of growth may have slowed -- 31 percent last year compared to 46 percent in 2012 -- but the dollar increase has increased. • SoundExchange Financials Show Fewer Unclaimed Royalties, Persistent Data Problems

Internet radio is monetized primarily by advertising, but the industry is a small player within the digital advertising ecosystem. Growth forecasts for internet radio advertising, though positive, are more modest than for other categories of digital ad spending. As the internet radio audience grows, the landscape of revenue models is changing rapidly. There are services that offer free, ad-supported subscriptions, ad-free access for monthly or annual fees, and subscription-only services. These figures are benchmarked from the Radio Advertising Bureau (RAB), which defines digital as follows: "All revenue derived from the [radio station] website including banner ads, tile ads, pop-up ads, internet/web streaming and dedicated streaming advertising, ecommerce, text and email messaging, other mobile media, and web-affiliate relationships (local or national)." The RAB also includes HD radio in its definition of digital. The full report, “Internet Radio: Marketers Move In” also answers these key questions: • How many people are using internet radio services, and how are they using them? This report is available to eMarketer corporate subscription clients only. eMarketer clients, log in and view the report now. |

| © Copyright 2016 Randolphe Entertainment Group | All Rights Reserved |